LOCAL residents are reeling from a shocking surge in home insurance prices following recent floods. The twist in this tale of financial woe? Many of the homes hit by these astronomical increases were not even affected by the floods. This situation has sparked a wave of outrage, with locals accusing insurance companies of exploiting fear for profit.

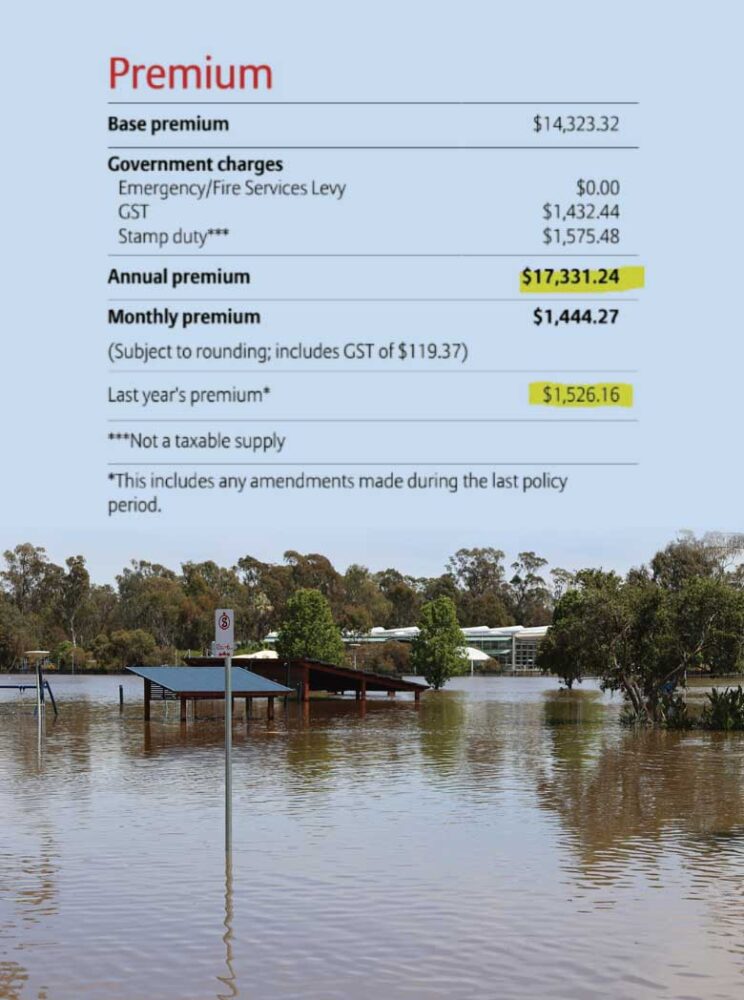

Neha Samar is among those locals bearing the brunt of this financial burden. Her annual insurance premium, provided by a major insurance company, previously a manageable $1,526, has skyrocketed to a staggering $17,331.24.

“Our house was not flooded. It’s not in an area that is listed as flood affected according to the DEECA flood portal,” Samar said, her frustration palpable.

“We feel betrayed by the insurance companies, feel as if they weaponise fear to make a profit. The housing crisis is bad as is, and now the insurance jump on all the houses – despite them [not] being flooded means renters pay even more and buying a house becomes a unicorn.”

In response to this untenable situation, Samar has since changed insurance companies. However, her story is far from an isolated incident. Other Shepparton locals, too, have reported their annual insurance costs rising over $10,000, regardless of whether their properties were affected by the floods or claims were made. This pattern suggests an indiscriminate increase, hitting homeowners hard regardless of their flood risk or history.

But Samar’s criticism doesn’t stop at insurance companies. She called out regional politicians for their lack of action, stating, “Our region’s politicians have failed to adequately represent the regional areas. They want people to move here but also make it impossible to do so by rolling over for profit making companies.”

This situation sends a clear message – it’s time for change. The insurance industry must be held accountable for these drastic price hikes, and our politicians must step up to protect the interests of regional Victorians. The community of Shepparton deserves better.